Case Study 4 : Meta Oculus

Prompt: Scale Meta’s Oculus to a larger audience, build a product to increase engagement and adoption rates

“Make the world more open and connected” - Meta

“To help bring the metaverse to life.” - Meta

Introduction & Product Background

Meta’s Oculus Quest 2 is a virtual reality(VR) headset developed by Facebook Reality Labs, the latest device Oculus Quest 2 released in September 2020 has already had a tremendous impact on the market. The metaverse is being built from the ground up to connect people to new immersive experiences in education and training to solve problems in healthcare, the workplace, and much more. People will be able to learn holistically by experiencing things more than just passively absorbing information, keeping in mind the economic opportunities, privacy, safety integrity, equity, and inclusion as its cornerstones.

In this case study, I try to decipher how Meta can approach this obstacle to increase engagement and adoption rates in a competitive hyper-growth market while retaining its unique value proposition(UVP) of making the world more open and connected. Hypothesis and solutions are derived based on my own data collection through polls and customer interviews within my network, and gauging current & future market trends backed by predictions and data. Since I do not have access to any of the internal data and consumer study reports, I’m relying on the data I’ve collected through personal means to make the best judgment possible.

2. Company Mission and Values, Roadmap, Products

Meta’s vision for its products is “To help bring the metaverse to life”, the entire ecosystem reflects that in the products it develops geared mostly toward creating a more open and connected world. While Meta’s Oculus has had quite a run-up to find its Product Market Fit over the last couple of years, now more than ever Meta needs to find solutions to differentiate itself from the rest of its competitors which are raising exponentially by the day to be the unanimous leader in the Metaverse market.

Image 2: Meta’s Introduction

3. Market and Competitors Analysis

Over the past two years, Meta has crushed the AR/VR headset market by grabbing the bulk of the market share. That’s already a great current trend because of the functions it provides at a low-cost barrier with minimal profit margins. While this isn’t a winner takes all market, the rest of the big tech AR/VR companies are yet to release their headsets and open up their platform. Apart from a small spike in interest in October 2021(when Metaverse was announced) from Google Trends, it’s clear that discoverability and search is still the major issue leading up to its adoption and engagement. While the technology is still in its infancy there’s fierce competition brewing with the rest of the big tech AR/VR products scheduled to hit the market in the next couple of years.

Indirect platform competitors: Apple AR/VR Reality OS, Microsoft HoloLens, Amazon Sumerian, Google AR/VR Iris, Roblox, Sandbox, HyperVerse, Decentraland, Nvidia Omniverse

Image 4: AR/VR Headset Forecast

Image 5: Oculus marketshare

4. User Research and Personas

In the real world, the process of collecting user data is the most critical one for defining a solution that lays the foundation for a future Product Market Fit. The wider the sources, the better data points but they don’t necessarily arrive at congruent conclusions. Knowingly or unknowingly, what people say they positively respond to, could be widely different from the ones they actually do in real life, so collecting both quantitate and qualitative metrics is essential to arrive at an optimized solution using a UX research data-driven approach.

For the purposes of this case study, I’ve simplified the process. I interviewed a wide range of people who are current & former Oculus users and others who use different AR/VR headsets and collated them to transform them into user personas.

Image Gallery 6: Meta Oculus - Stages through a guided meditation in the Metaverse - from tense to relaxed

Image 7: Meta Oculus - User Personas

5. Brainstorming Solutions

Product solutions start absolutely with the customer pain points. While it’s tempting to solve every user problem from every segment possible, there’s always a tradeoff between risk vs rewards offering the highest value which dictates what features get built with priority to be built

While short-term solutions and fixes have their place in the product cycle, they might not impact the customers immensely or bring everlasting gains to the organization. Hence, building toward solving a big enough problem with a bigger market opportunity by brainstorming moonshot ideas helps the final product land somewhere in the middle of reality, after discounting for unknown complexities/roadblocks ahead.

Image 8: Features prioritized using RICE Framework

6. Prioritization, Tradeoffs for ROI, and Success metrics/KPIs

In the real world, product shortlists and feature prioritization is done with abundant customer studies, surveys, internal & external data with quantitative ranking, and formulating matrices with values directly tied to the customer feedback which align with the organization’s mission and goals. Feature prioritization reduces the risk of building a product that burns resources, in addition to the opportunity costs of not building the product that the customer desired in the first place. Additionally, it improves the probability of a big return on investment (ROI).

There are plenty of product prioritization frameworks used to decide which product/feature to build, here are a top few:

a) The Kano Model: Mapped on a 2-dimensional plot with user satisfaction vs functionality, the highest delight and functionality are chosen.

b) The MoSCoW method: Must have, Should have, Could have and Wont have, the best solution bubbles up via feature eliminations.

c) RICE Framework: Reach, Impact, Confidence, and Effort. The feature with the highest formulated RICE score gets the pick.

d) ICE Scoring Model: Impact, Confidence, and Ease. The highest relative average ICE score features bubbles to the top.

e) Opportunity Scoring: Evaluates the feature importance, customer delight, and satisfaction.

f) Weighted Scoring Prioritization: Numerical scoring which ranks strategic initiatives against cost/benefit categories for prioritization

When features are chosen to prioritize with any of these frameworks, logically it makes sense put all the focus and resources to pick the highest scoring feature to build. But it might or might not be the best path to go after strategically. The reason is, that there are plenty more parameters to consider during a product cycle like resource interplay, tech debt, competitor’s pressure with time to market, complexity with the tech stack, engineering resource constraints, and blockages with any or all of those in conjunction.

To simplify this case study, I don’t have access to all the consumer studies and user research, but I have relied on the data collected, coupled with my intuition for what the future marketplace needs, keeping in mind Intuit’s global market positioning to arrive at an informed decision.

6.1 Short to mid-term product to build - Interoperability between Oculus/FB/IG Apps:

My hypothesis for choosing the Interoperability between Oculus/FB/IG Apps solution is primarily rooted in customer empathy and the pain points it’s able to resolve with the value it delivers holistically, in a post-pandemic world where digital interactions are laying a foundation for a future world.

The GenZ population has had a rough time in the physical world in the post-2020 era ranging from global wars to pandemics to economic slowdowns leading people to travel and connect less with others. This situation is what Meta can leverage, to build a product that helps users lower the friction to help connect its users to a virtual world where they control their destiny and be whoever they'd like to be in an alternative universe experiencing things immersively where our natural and digital lives merge, resulting in a single, virtual society in which we could work, play, rest, transact, and interact holistically.

The more users Meta Oculus has, the more content it can create and facilitate for large-scale adoption leading to more data points for clustering, filtering, and trend analysis using Meta’s algorithms.

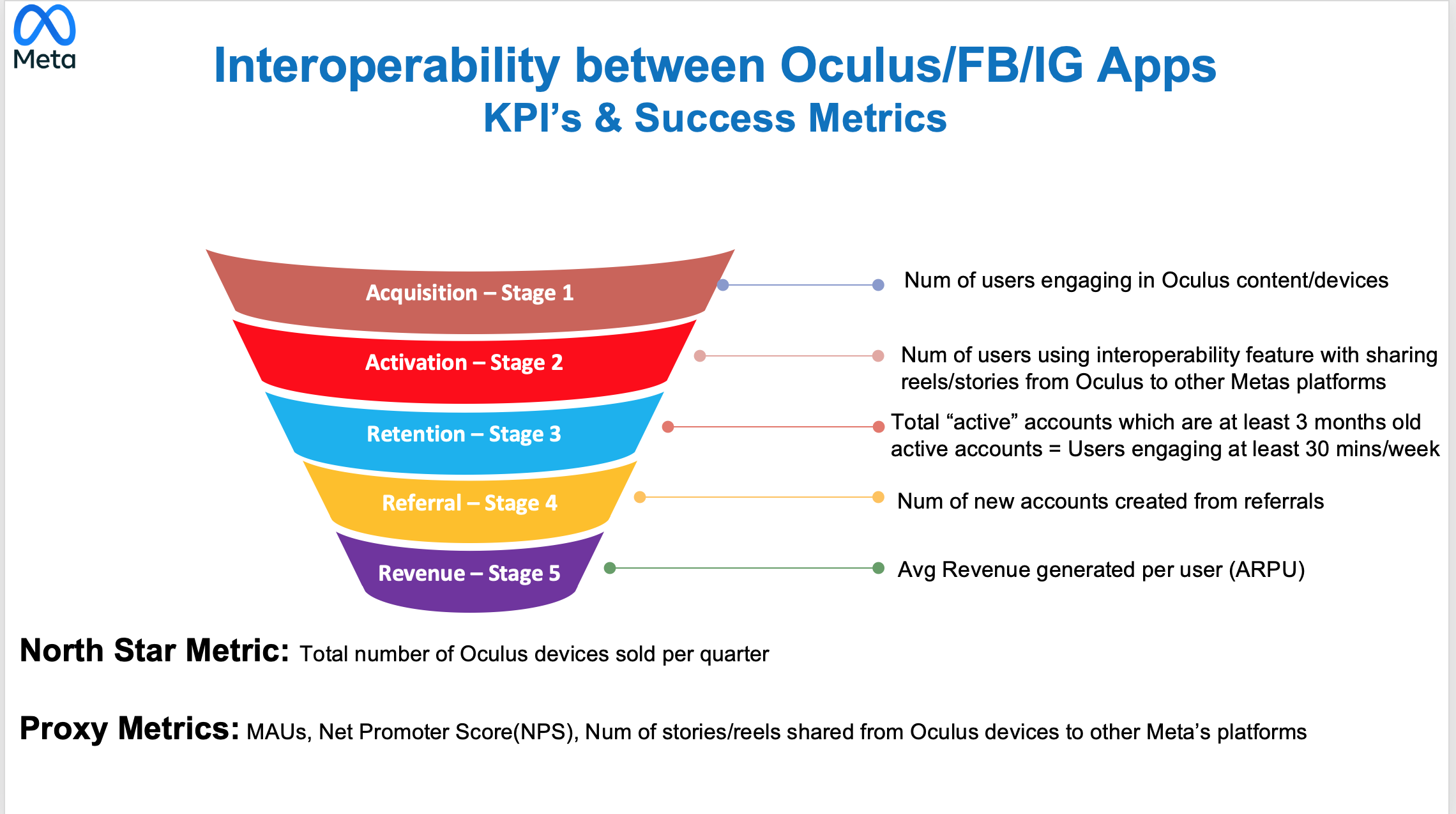

The North Star Metric(NSM) for this feature is primarily the number of headsets sold per quarter. Meta’s revenue streams are predominately from app purchases on the Metaverse, so the more people begin to use Oculus products, the faster the scale of inventions and the building of a complete Metaverse. So this meaningful metric predicts the product’s future success. Other KPIs and success metrics are listed through the funnel in the GTM strategy section of the blog.

The biggest risk to these features is still central rules to be built around privacy, criminal laws, security, and identity. Since the market is primarily geared toward young adults, access to equality and future health concerns need to get addressed with no room for interpretation.

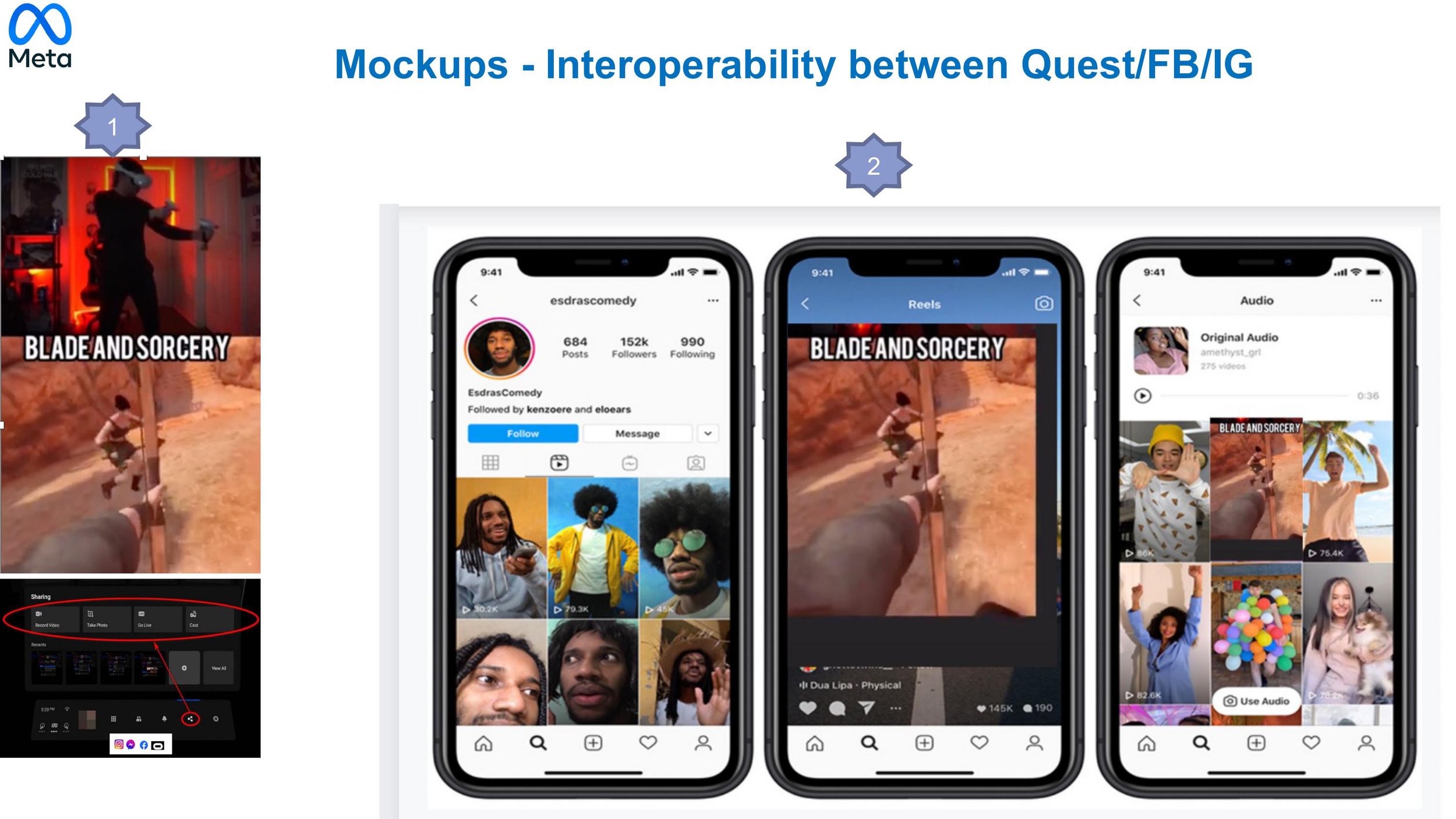

Even with the risks involved, when executed strategically and incrementally, launched to segmented user profiles, with sharing algorithms tuned for optimizations, personalization, ranking, and search. This scalable feature is indeed a great value add to the user addressing a major pain point of discoverability helping Meta’s users communicate seamlessly across all platforms.

Image 9: Effort vs Impact & ROI estimation

Image 10: Prioritization of solutions

Image 11: Core problem analysis

7. Minimum Viable Product(MVP), A/B testing for Product Market Fit

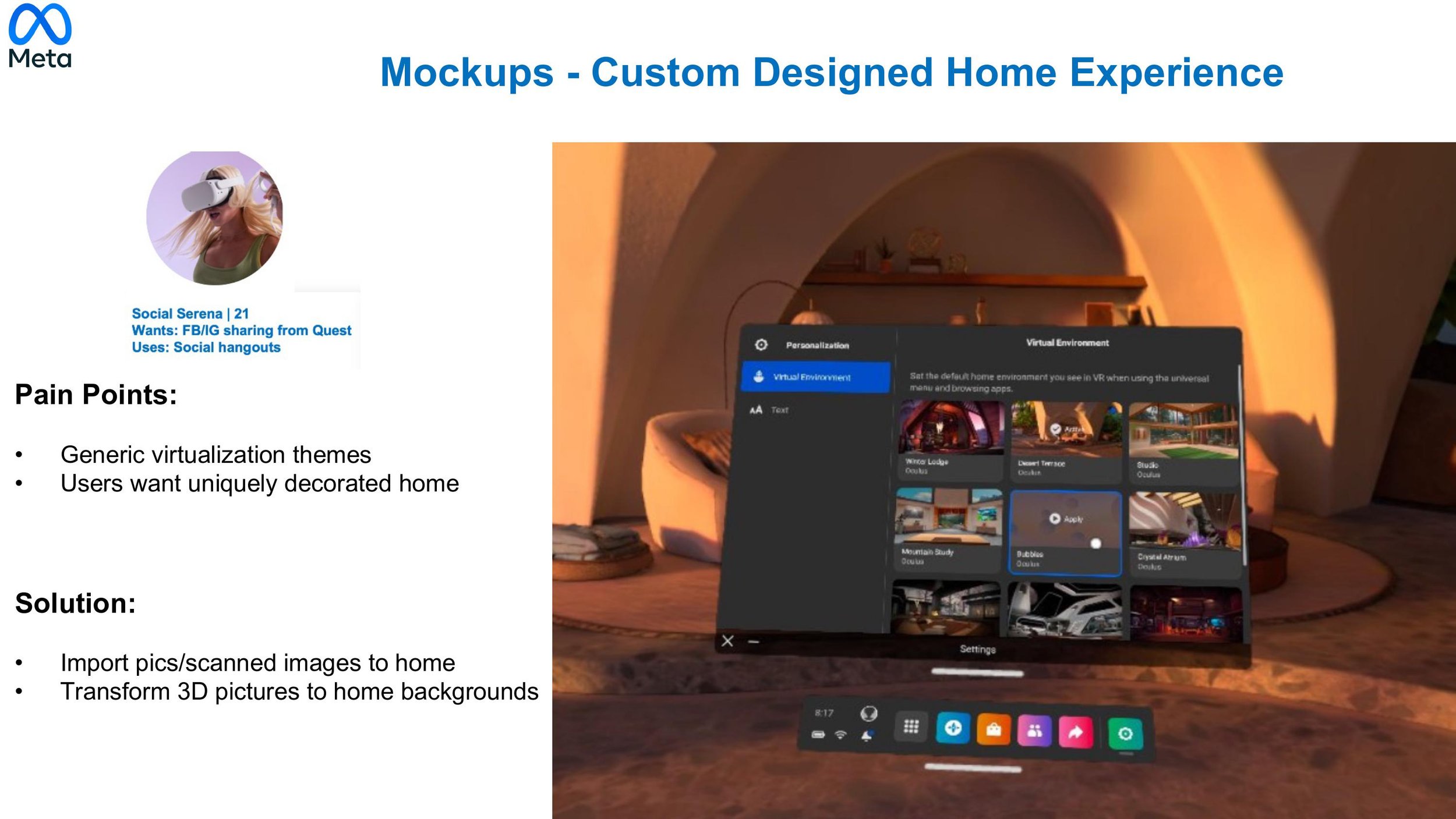

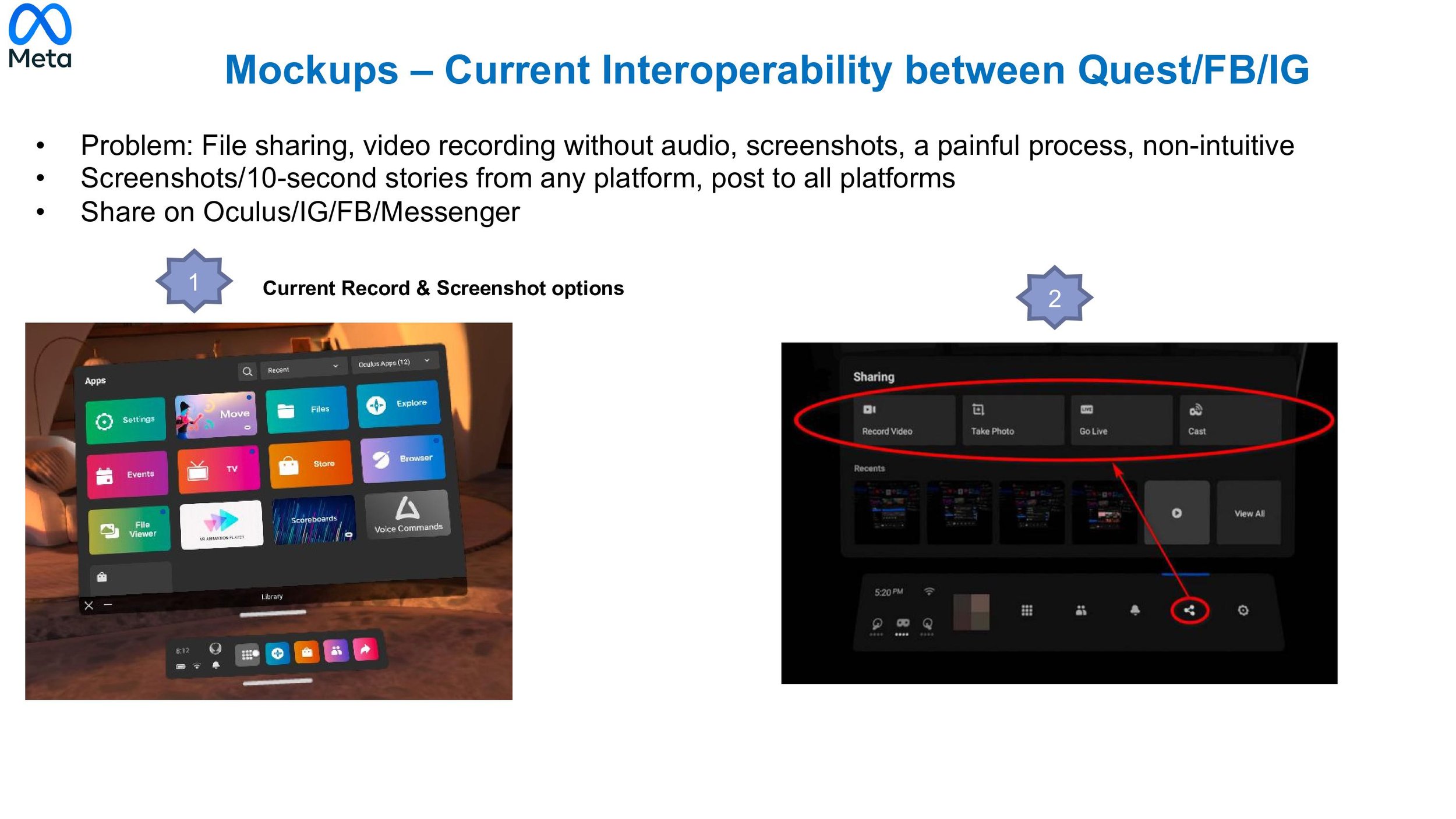

Building the MVP starts with creating custom APIs for sharing between platforms. Currently, Meta does not have this feature, the ability to create, record, and share short-form content across other products help in better discoverability and engagement of Oculus products and experiences. Also expanding the feature to fully customizing & furnishing the virtual home with accessories and skins and inviting/visiting others via teleport feature into my virtual home is all part of a long-term expansion plan in the Metaverse.

Something which needs extra attention is defining a clear data governance policy around holding and sharing digital assets information diligently, since the platform holds vast data with almost half of the world's population, what data to share with 3rd party apps is paramount.

Image 12: Product Roadmap for the future

8.Wireframes & Mockups:

Image 13: Suggested custom designed home experience

Image 14: 360 Degrees photos to 3D images for home backgrounds

Image 15: Virtual home invite feature

Image 16: Avatar to photo generation

Image 17: Avatar to photo generation mockups

Image 18: Photo to avatar generation mockups

Image 19: Interoperability between Meta’s platforms

Image 20: Current Interoperability

Image 21: Proposed Interoperability

Image 22: Proposed Interoperability sharing

9. Go-To-Market Plan, Product growth & scaling

Go-to-Market(GTM) is basically a step-by-step plan with every detail to successfully launch the product. Having a good GTM strategy helps in identifying the market problem for a refined set of users and delivering personalized value to them by positioning the product as their solution. In the real world defining TAM, SAM, SOM, and ICP numbers are highly critical in determining the market share of the problem. While it does involve referring through a lot of data sources to determine the market size and the portion controllable by the product. For the scope of this case study, I have used justifiable numbers from assumptions and estimations shown below.

Image 23: GTM Statistics

9.1) Revamp the strategic narrative aka manifesto with a clear new value proposition

Launching the feature with a purpose, aka manifesto plays a crucial role in getting the product to the hands of the users. It needs to be eye catchy, and convey exactly the message the product is solving with a call to action to which the users resonate vividly. Yes, that’s a lot of things in one, but think of all the eye catchy slogans from great products, the fact that you can recollect so of them shows powerful this step is in connecting with the audience. “Create your digital twin” is asking people to create their lives in the Metaverse to be everything they want.

Image 24: GTM Strategy

9.2) Identifying the initial customer profiles, average customer value, and ideal customer profiles

While the target persona is fairly well defined, for the product to work with a high engagement rate, it needs to be exposed to the right audience aka ideal customer profile(ICP). Using various data sources to target these user segments helps the product to get traction very rapidly.

9.3) Execution, Sales, Marketing, and Customer Acquisition Costs

Pinning down the exact customer acquisition cost (CAC) with a pricing model to increase game purchase prices is a key driving factor in revenue generation in the long term, additionally allotting a budget to regain lost customers to welcome them back to retry the improved product games can help boost engagement and increase adoption.

Image 25: Success Metrics and KPI’s

10. Summary

In this case study, I’ve tried to decipher how Meta can approach the problem of scaling its Oculus user growth to increase engagement and be the leader in the AR/VR world through evolving its UVP and interoperability features. While there isn’t a perfect solution, hedging risks, managing tradeoffs, and finding product-market fit to satisfy customer needs are the most preferable options to release new products.

Out of all the solutions, I could come up with, Interoperability between Oculus/FB/IG has bubbled up as the top solution through my framework and analysis. While there could be some anticipated friction with a few user segments with data privacy worries, when addressed well it can be put away, but the idea does have merit and long-term potential when strategically implemented.

We’re at a crucial point in the digital age, where Web3/XR, Metaverse, Digital Twins, and Omniverse are redefining industries, changing people’s lives for the better, and attracting the attention of global businesses and institutions. While this presents an untold opportunity, the risk of poor direction, the absence of collaboration, and undefined standards could lead to a space that is mediocre at best, and at worst purely undesirable. This is Meta’s chance to take charge and redefine an inclusive digital future together, like the way it did in the early 2010s.

Image 26: Meta Oculus Executive Summary

Outro:

Hardware and battery remain a big bottleneck with scaling devices in the Metaverse. With the high fidelity blurring of lines in alternate realities, what our future looks like is hyperrealistic and it’s hard to believe how quickly the real and virtual lines of existence are fading.

If there is one thing you’d want to take away from this case study, it’s the phenomenon of “Phantom Sense”, you need to experience it to believe in the future of AR/VR/XR technologies.

Here is the TLDR version in a pitch deck.

Disclaimer: All opinions shared on this blog are solely mine and do not reflect my past, present, or future employers. All information on this site is intended for entertainment purposes only and any data, graphics, and media used from external sources if not self-created will be cited in the references section. All reasonable efforts have been made to ensure the accuracy of all the content in the blog. This website may contain links to third-party websites which are not under the control of this blog and they do not indicate any explicit or implicit endorsement, approval, recommendation, or preferences of those third-party websites or the products and services provided on them. Any use of or access to those third-party websites or their products and services is solely at your own risk.