Case Study 2 : Netflix

Prompt: Netflix subscribers’ growth & revenue projections are beginning to stagnate, build a product to combat this problem.

“Stories move us. They make us feel more emotion, see new perspectives,

and bring us closer to each other.” - Netflix

“

“At Netflix, we want to entertain the world. Whatever your taste, and no matter where you live, we give you access to best-in-class TV series, documentaries, feature films and mobile games.” - Netflix

Image 1: Netflix stagnating subscriber growth & marketshare

Introduction & Product Background

Netflix is a mature online streaming service product, which saw its highest growth of subscribers during the peak of the pandemic, overtime the streaming market has been flooded with competition. Netflix is feeling the pressure of this with declining subscribers, followed by decreased revenue expectations based on future guidance. Netflix announced the release of new ad-supported plans by the end of 2022 to raise revenue. Also, password sharing between users has had quite an impact on its subscriber’s growth which is a tough problem to crack and beyond the scope of this case study. I will focus only on ideas backed by data, which promotes holistic growth for users and Netflix in the long term.

In this case study, I try to decipher how Netflix can approach this obstacle to extend its top place in the online entertainment market while retaining its unique value proposition(UVP) of the art of storytelling. Hypothesis and solutions are derived based on my own data collection through user interviews within and outside my network, polls, and market trends. Since I don’t have access to any of the internal data and consumer reports, I’m relying on the data collected through personal means and online sources to make the best judgment possible.

Image 2: Netflix vs Others retention & churn metrics, root cause analysis for cancellation

2. Company Mission and Values, Roadmap, Products

Netflix’s vision is “Becoming the best global entertainment distribution service”. This statement has been truly reflected in the nature of the company’s operations since its inception in providing on-demand movie streaming services and staying ahead of technology which commands a market share of over the 50% of the global entertainment distribution service. Netflix helps content creators around the world find a global audience. Like most great companies, they value integrity, excellence, respect, inclusion, and collaboration.

3. Direct & Indirect Competitors Analysis

Direct competitors: Hulu, Disney+, ESPN, Peacock/Comcast, Amazon video, YouTube video

Indirect competitors: TikTok, YouTube shorts, Facebook stories & videos, Instagram stories

Netflix enables people to watch as much TV and movies as they like in the comfort of their homes. While this unique value proposition (UVP) appealed to its users 15 years ago, with the threat of new entrants and substitutes in the market providing the same and more, users are left wondering about the paradox of choice. It’s going to be an uphill battle to, scale a mature product, reduce churn and increase revenue without adding a long-term value creator with novelty to meet current and future market demands. That being said, there are immediate steps that can be taken for reclaiming their lost market share and extending it to other auxiliary horizontal markets.

Image 3: Porter’s Five Forces & measuring retention metrics of competition

4. User Research and Personas

The process of collecting user data is the most critical one for defining a solution that lays the foundation for a future Product Market Fit. The wider the sources, the better data points but they don’t necessarily arrive at congruent conclusions. Knowingly or unknowingly, what people say they positively respond to, could be widely different from the ones they actually do in real life, so collecting both quantitate and qualitative metrics is essential to arrive at an optimized solution using UX research data-driven approach.

For the purposes of this case study, I’ve simplified the process. I interviewed a wide range of people who are current, former, and non-Netflix subscribers and collated the data to transform them into these user personas.

Image 4: Netflix User Personas

5. Brainstorming Solutions

Coming up with product solutions starts absolutely with the customer pain points. While it’s tempting to solve every user problem from every segment possible, there’s always a tradeoff between risk vs rewards which dictates what features need to get built with a priority.

While short-term solutions and fixes have their place in the product cycle, they might not impact the customers immensely or bring everlasting gains to the organization. Hence, building toward solving a big enough problem with a bigger market opportunity by brainstorming moonshot ideas helps the final product land somewhere in the middle of reality, after discounting for unknown complexities and roadblocks ahead.

Image 5: Brainstorming solutions

Image 6: Effort vs Impact & ROI of solutions

6. Prioritization, Tradeoffs for ROI, and Success metrics/KPIs

In the real world, product and feature prioritization is done with abundant amounts of customer studies, surveys, internal & external data with quantitative ranking, and formulating matrices with values directly tied to the customer feedback which align with the organization’s mission and goals. Feature prioritization reduces the risk of building a product that burns resources, in addition to the opportunity costs of not building the product that the customer desired in the first place, conversely improving the probability of a return on investment (ROI) down the line. There are plenty of product prioritization frameworks used to decide which product/feature to build, here are a top few:

a) The Kano Model: Mapped on a 2-dimensional plot with user satisfaction vs functionality, the highest delight and functionality are chosen.

b) The MoSCoW method: Must have, Should have, Could have and Wont have, the best solution bubbles up via feature eliminations.

c) RICE Framework: Reach, Impact, Confidence, and Effort. The feature with the highest formulated RICE score gets the pick.

d) ICE Scoring Model: Impact, Confidence, and Ease. The highest relative average ICE score features bubbles to the top.

e) Opportunity Scoring: Evaluates the feature importance and customer delighter and satisfaction.

f) Weighted Scoring Prioritization: Weighted aggregation of important feature drivers used to quantify the importance of a feature.

When features are chosen to prioritize with any of these frameworks, logically it makes sense put all the focus and resources to pick the highest scoring feature to build. More often than not, it might or might not be the best path to go after strategically. The reason is, that there are plenty more parameters to consider during a product lifecycle like resource interplay, tech debt, scope creeps, competitor’s pressure with time to market, complexity with the tech stack, engineering resource constraints, and blockages with any or all of those in conjunction.

Considering I don’t have access to all the consumer studies and actual user research, I’m going to rely on the data I have collected, coupled with my intuition for what the future market place needs and Netflix’s current global market positioning to arrive at an informed decision.

6.1 Short-term product to build - Shorter Weekly Episodes, Food Delivery integration

My hypothesis for choosing Shorter Weekly Episodes and Food Delivery integration is deeply rooted in the user pain points of decision fatigue, unhealthy binge-watching habits, and lacking novelty products for stimulation backed by quantitative data. Not just for the users, the sheer unsustainability to keep churning out new Netflix shows and movies frequently focussing on quantity over quality require intensive capital investments which without user retention is hard to justify.

With shorter video formats being more engaging to users and being generated for free, Netflix being a mature product is unable to match and pivot to the same level of producing or match engagement with longer shows. With a diminishing novelty experience for the user, there’s a high risk of capital investments for producing new shows to induce higher success probabilities.

Hence, this solution focuses on providing the users with a holistic at-home luxury weekly watching experience indulging in more of their senses to ease their decision fatigue, and to connect with the shows and characters better leading to higher retention. Netflix cannot burn through millions of dollars on the probability of occasional popular shows but can improve the quality of engagement which solves user’s pain points and in turn benefits Netflix in the long term with a lower spending budget.

Image 8 : Current vs Proposed impact on users senses and connection of content consumed

Image 9 : Prioritization of solutions

Image 10: User journey map of Ideal Customer Profile(ICP)

6.2 Long Term product to build, Moonshot idea(1-3 years)

There’s a massive untapped market in the XR gaming and video segment for the personalization of characters, skins, and home environments using crypto wallets for transactions. Companies such as Roblox and PUBG have already validated this big opportunity for market demand. Will future Netflix products include some sort of short, stimulating & immersive entertainment experiences to meet draw Gen Z user groups into it is yet to be known, but other platforms building their metaverses have a UVP and target market defined which is always unique and personalized to every user in a more immersive and impactful way where the lines of reality and the virtual world start to become blurry.

While on-demand streaming will exist alongside it, the scale and scope of growth are unmatched without some integration of XR technologies.

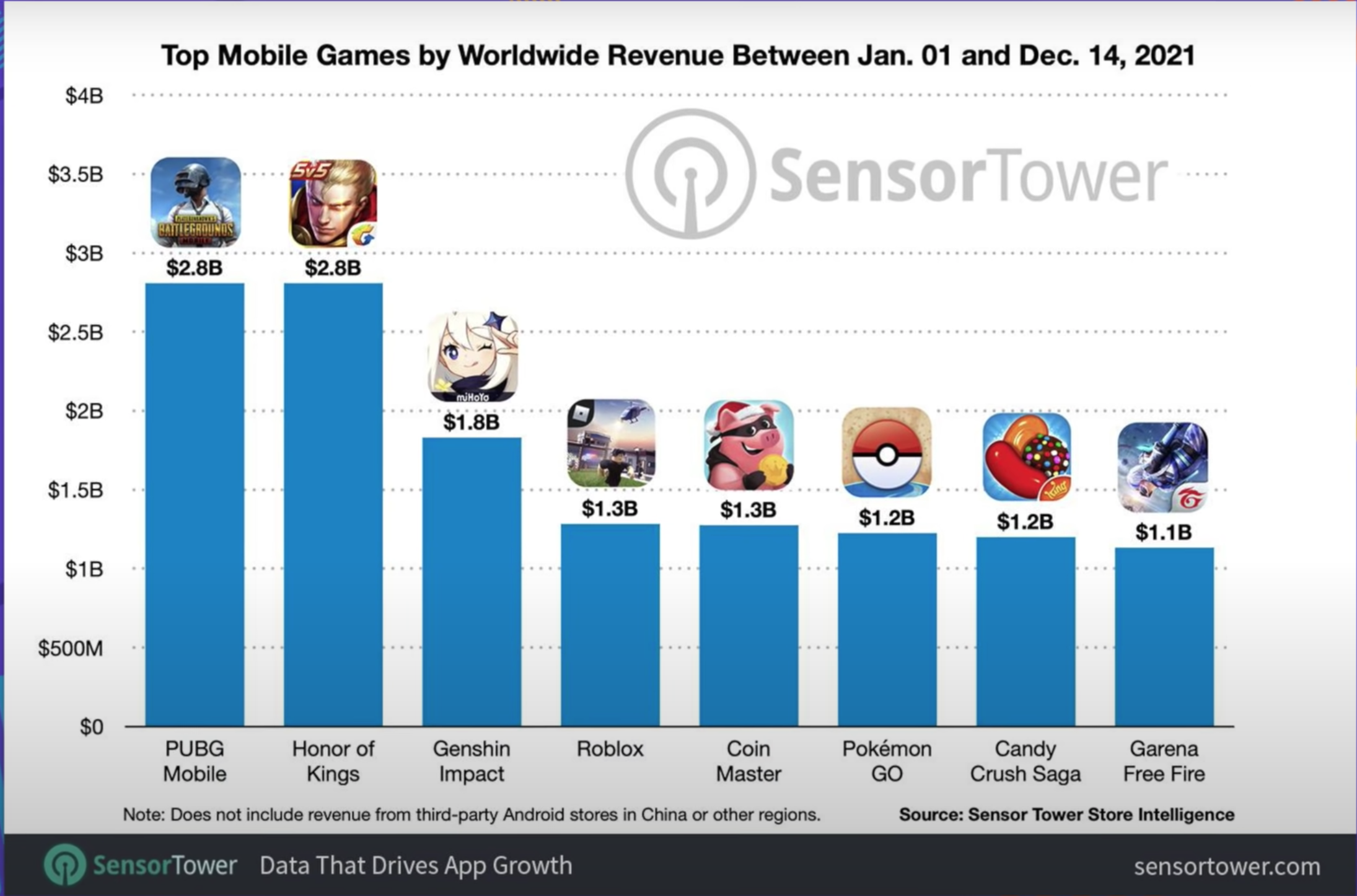

Image 12: Online gaming platforms market opportunity, image courtesy sensortower.com

Image 13: Moonshot vision AR/VR Gaming platform on Netflix

7. Minimum Viable Product(MVP), A/B testing for Product Market Fit:

There isn’t one single metric that can determine a product market fit for a certain feature or product. A mix of quantitative and quantitative metrics such as the Net Promoter Score(NPS), Retention rates, Churn rate, Growth rate, and Market share alongside measuring the products popularity, referrals, and virality usually help with fine-tuning the product.

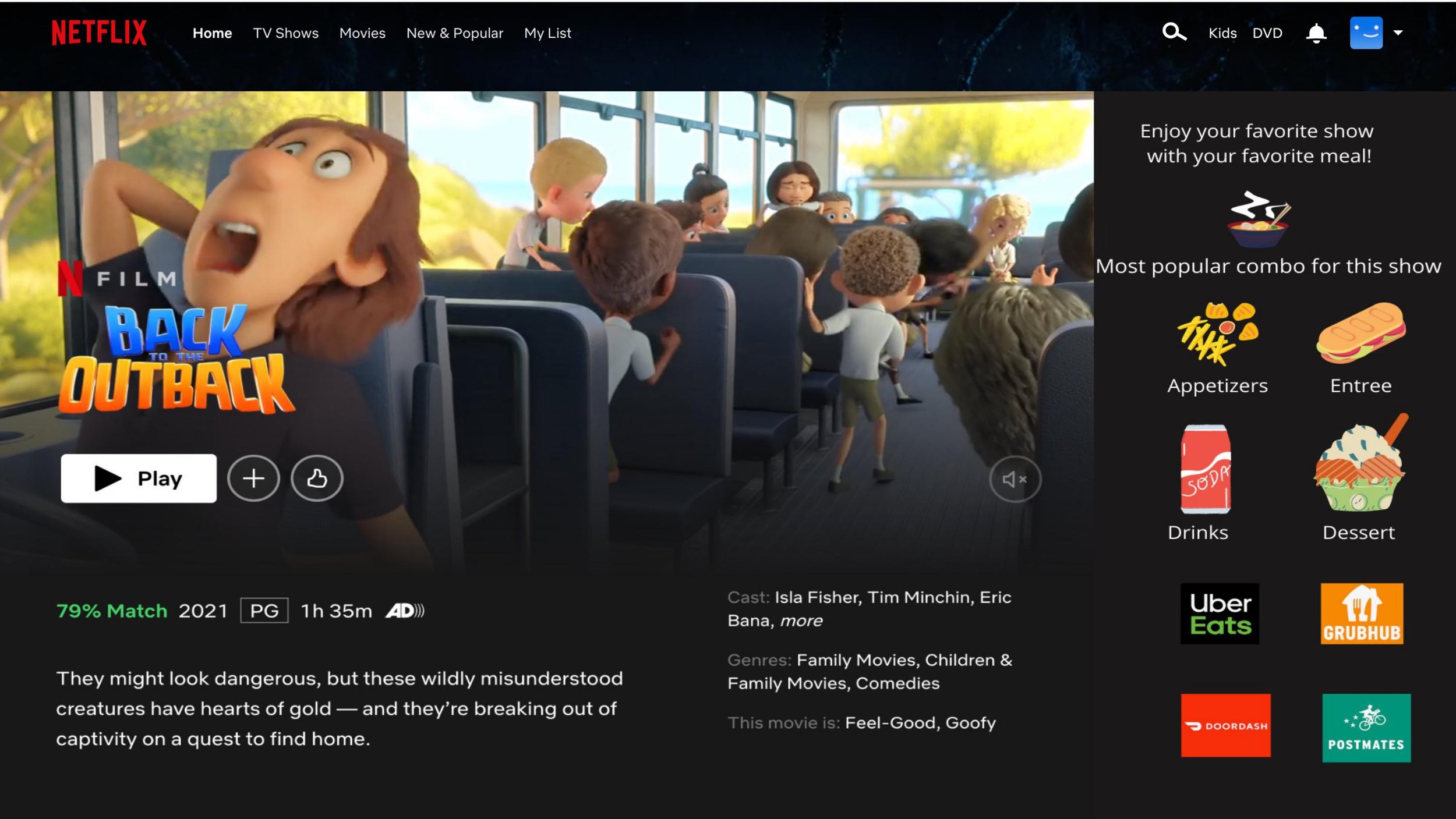

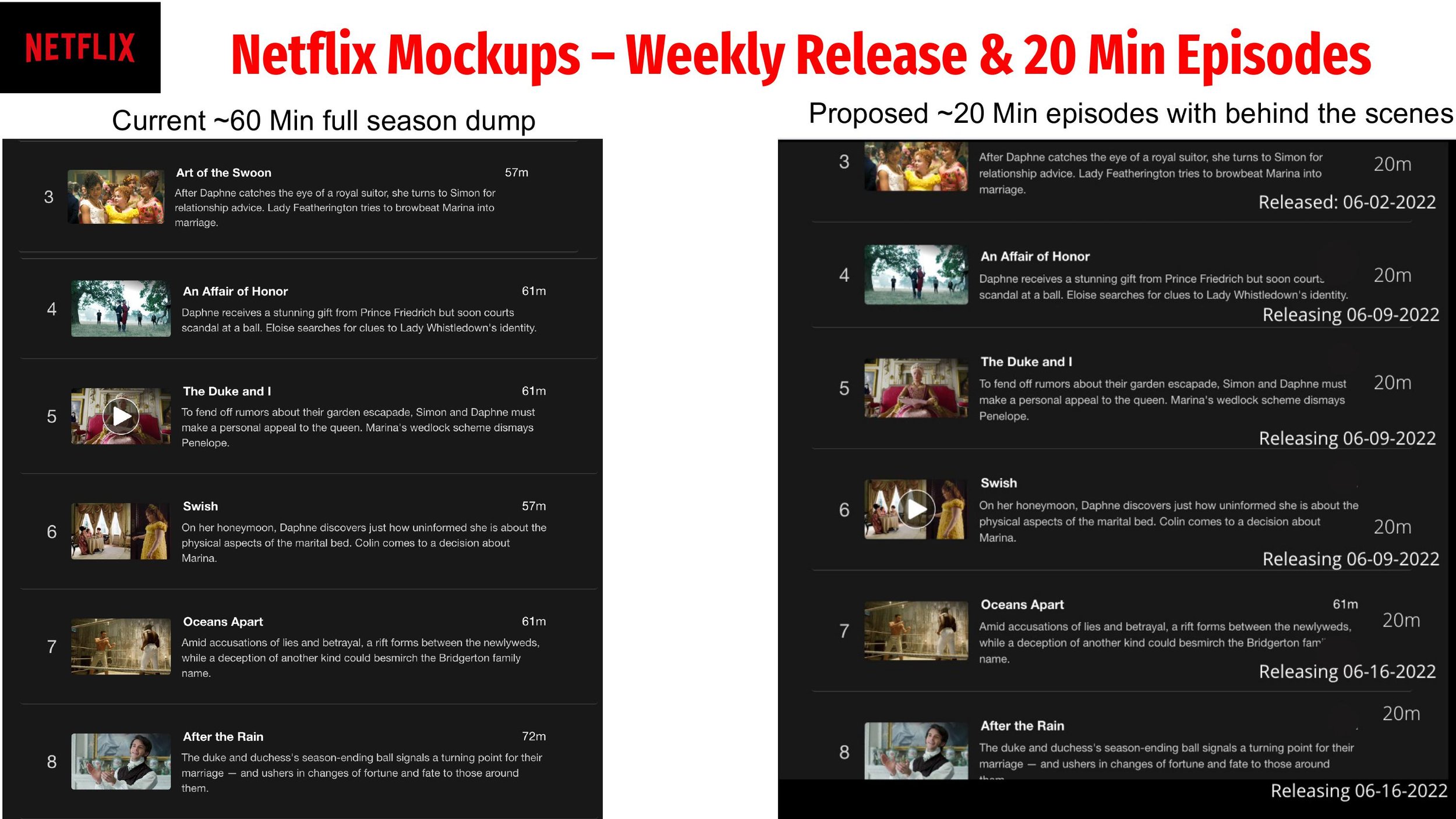

Building the MVP starts with reframing the longer episodes to shorter 20 min episodes on 3, with a chance to know the characters from the scenes which helps the users be more involved in the show.

For A/B testing of the feature, generating suggestions for food preferences based on the theme of the show helps users feel more connected while consuming both the show and food activating more of their senses leading to user delight. A/B testing the results of the experience and retuning the best pairing of shows and foods enjoyed together gives the show a better chance of being consumed by the users. It goes without saying that enough qualitative and quantitative metrics collection is needed to fine-tune this strategy with a clear data-driven approach and a clear hypothesis with high confidence intervals for Product Market Fit before the final product can be rolled out.

Image 14: Product build roadmap

8.Wireframes & Mockups:

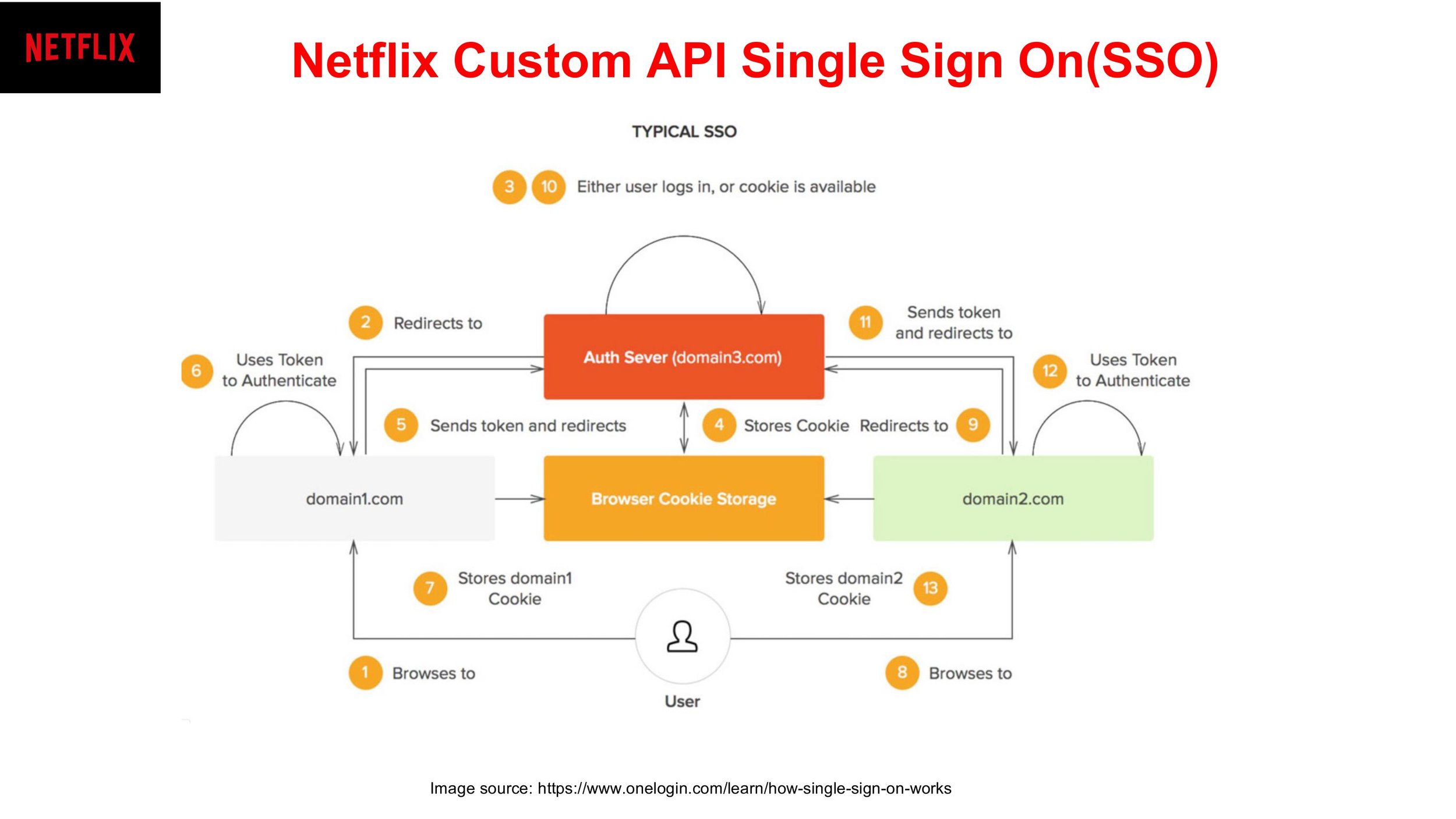

Image 15: SSO Architecture

Image 16: Product build roadmap

Image 17: Sign up flow for account personalization

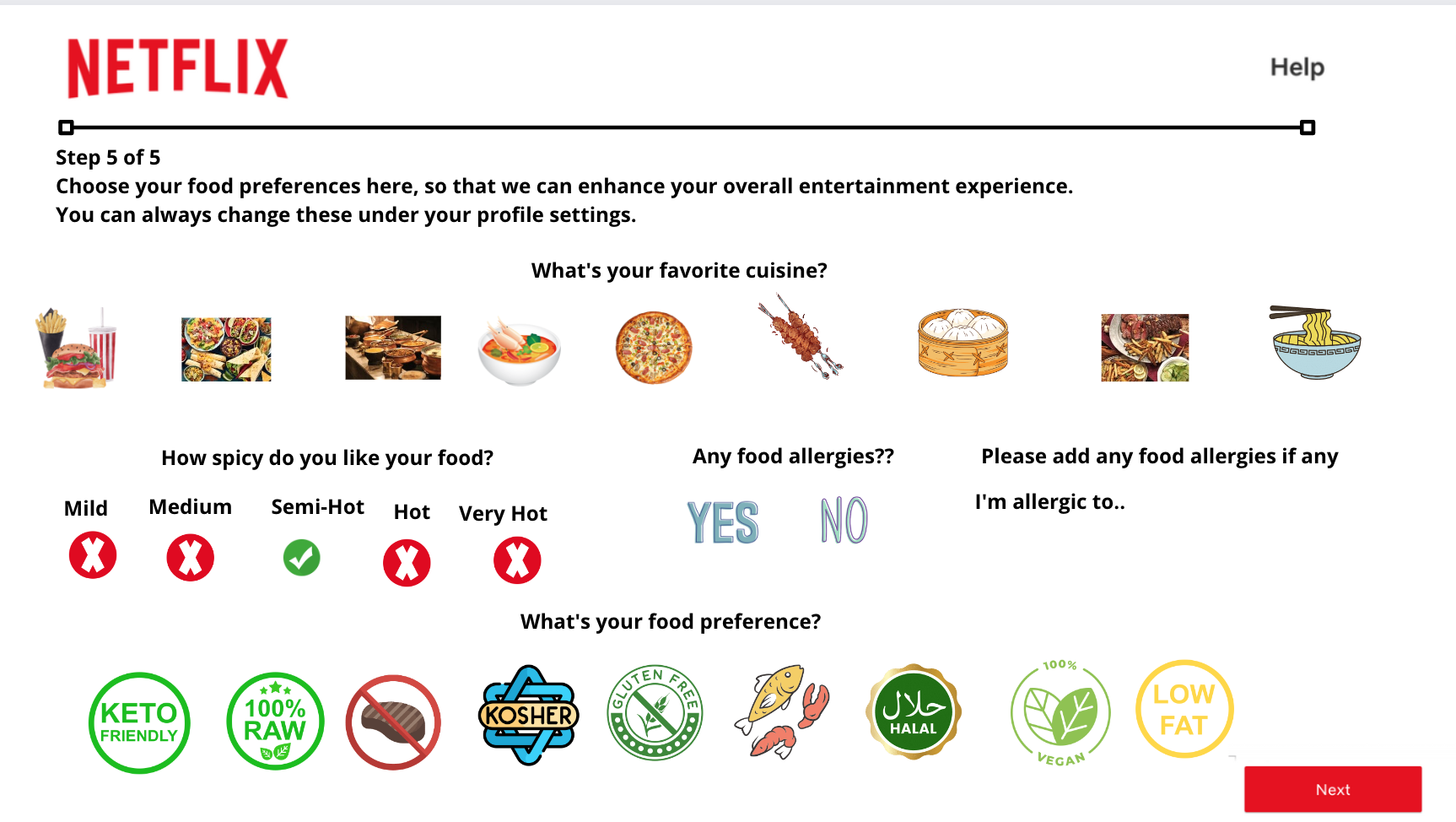

Image 18: Additional sign up flow for food + entertainment account personalization

Image 19: Food delivery apps API integration architecture

Image (gallery)20: Themed food, drinks & dessert suggestions experience to pair with various genres of Netflix shows

Image 21: More episodes with shorter length, weekly releases vs season dumps

Image 22: Additional behind the scenes footage to get intimate with the show’s characters in real life

9. Go-To-Market Plan, Product growth & scaling:

Go-to-Market(GTM) is basically a step-by-step plan with every detail to successfully launch the product. Having a good GTM strategy helps in identifying the market problem for a refined set of users and delivering personalized value to them by positioning the product as their solution. In the real world defining TAM, SAM, SOM, and ICP numbers are highly critical in determining the market share of the problem, without which every innovative solution will fall flat. It involves referring to accurate data sources to determine the market size and the portion controllable by the product. For the scope of this case study, I have used justifiable numbers from assumptions and estimations shown below.

9.1) Revamp the strategic narrative aka manifesto with a new value proposition and Call to Action:

Image 23: GTM Statistics

Fine-tuning the messaging and revamping to reintroduce Netflix’s new value proposition is a key component of this GTM strategy. One way of doing that is by valuing Netflix’s best shows at the highest level and having a tighter roadmap around them. Also, repackaging the tagline to match the efforts from“See what’s next?" to “Watch the best, forget the rest!” truly embodies the messaging around the GTM plan. A gradual shift from an “all you can eat” business model to a “fine dining” experience is what this idea offers.

All new to-be-released shows based on popularity, region, and genres are to be repackaged as “Premium Shows” and accessible only on premium accounts. Lower tired accounts can earn watch credits though soon to be releasing ad’s feature. For example, in Japan, anime shows, and in India romantic shows should be a part of premium shows since those are the most popular genres in those specific regions respectively.

9.2) Identifying the initial customer profiles, average customer value, and ideal customer profiles, using multiple channels for messaging and recommending personalized shows.

Encourage users to fill out profile information for the personalization of shows and food options. Track KPIs month over month and reiterate.

Image 24: Revamped GTM Manifesto

9.3) Execution, Sales, Marketing, and Customer Acquisition Costs :

Pivoting to a bi-weekly Thursday night episode release schedule for new shows increases the anticipation for premier show episodes. The best example is how HBO handled the Game of Thrones episodes which were strategically executed. The weekly gap in episodes gives the users a chance to catch up and debate character traits and predict show endings which all adds up to the free word-of-mouth publicity and marketing for Netflix Premium shows. As for pricing, pinning down the exact customer acquisition cost (CAC) with a pricing model to increase revenue is key, additionally, assign a discretionary budget for regaining lost customers to interest them back for a new 30-day trial for new shows.

Image 25: Revamped GTM Manifesto

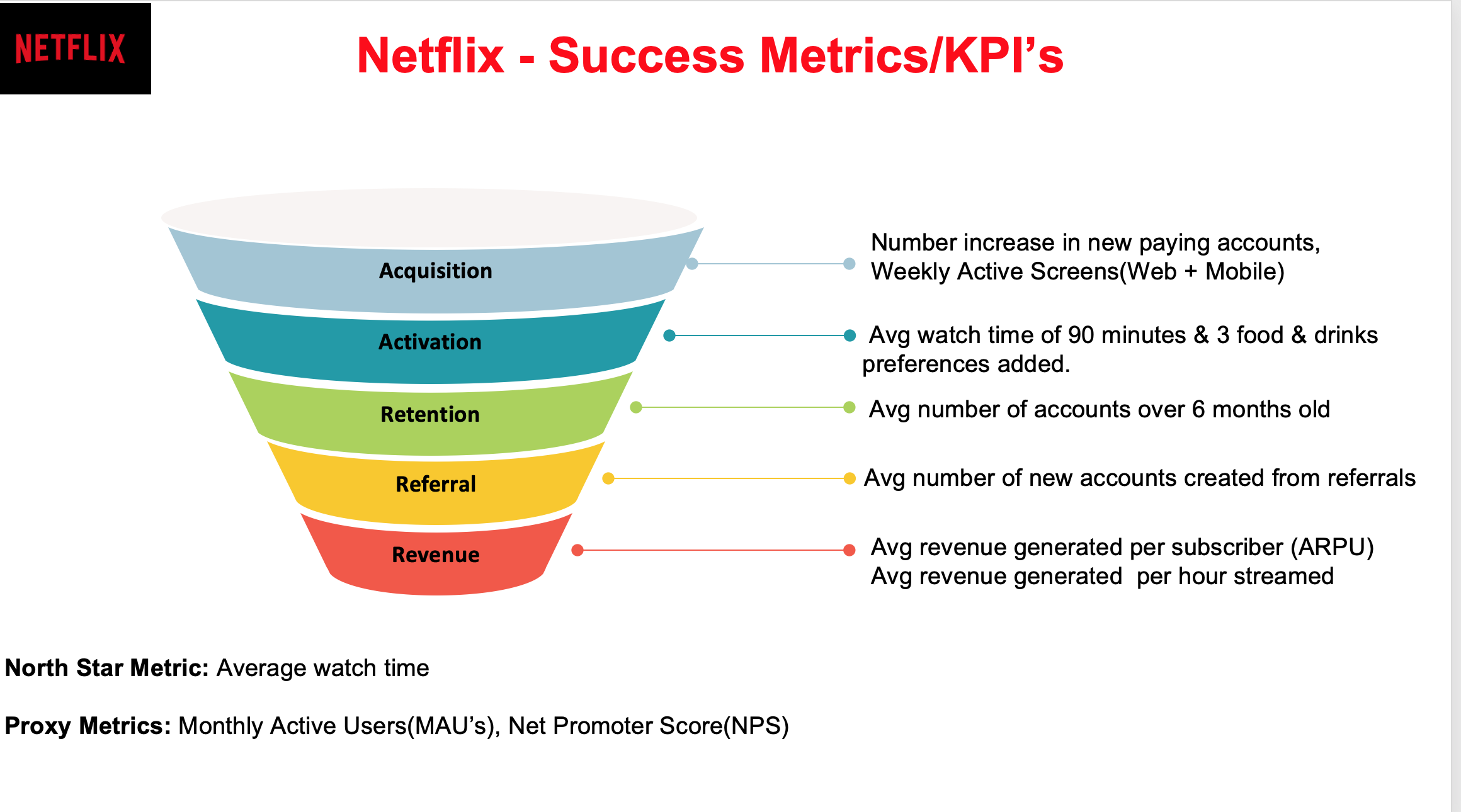

Image 26: Success Metrics/KPI’s

10. Summary

In this case study, I’ve tried to decipher how Netflix can approach the problem of stagnating subscriber growth to extend its top place in the online entertainment market with the process of evolving its UVP. While there isn’t always a perfect solution, hedging risks, managing tradeoffs, and finding product-market fit to satisfy customer needs in the near term are the most preferable options to release new products.

In a different competitive landscape, economic and global environment, other options could have been more attractive. But as of now, solving the pain points of decision fatigue and retention issues to bridge the gap with holistic themed food and Netflix show experiences and strategic weekly show releases seems to be the best possible route for lowering the spending on new shows and creating exclusivity to the premium users.

All things considered, with the raise in competitors, the threat of substitutes in short video and gaming, and a raising interest rates environment, the ideas with the lowest risk providing the highest user delight focussed on generating cash flow will be rewarded the most.

Out of all the solutions, I could come up with, Shorter Weekly Episodes and Food Delivery integration has bubbled up as the top solution through my framework and analysis. While it could deter some subscribers who are used to binge-watching shows in the short term, the idea does have merit and long-term growth and retention potential should the new Netflix Premium shows be strategically released.

Outro:

Almost 15 years ago, Netflix paved the way for high-definition video streaming when the rest were selling CD disks, DVDs & DTH services. Since then, Netflix has had wind under its sail with tremendous growth leveraging Amazon’s AWS cloud in availability, capacity, and scaling. With handheld devices turning into pocket computers, the market has been conducive to online streaming resulting in it being over-served with similar content, now more than ever that space is ripe for disruption.

Users in the future want to not just view and listen to experiences, but be a part of that experience immersively. By that measure, Netflix’s current unique value proposition(UVP), of the art of storytelling is gradually fading. In the medium term, XR games and shows are slowly taking precedence redefining entertainment to be immersive out-of-body experiences.

Can Netflix lead the way again to re-introduce a new brand of entertainment experiences generating the most value to its users on their platform, only time will tell…

How would you solve Netflix’s problem? What would you do differently?

Write to me with your thoughts, I’d love to hear from you!

Here is the TLDR version in a pitch deck.

Disclaimer: All opinions shared on this blog are solely mine and do not reflect my past, present or future employers. All information on this site is intended for entertainment purposes only and any data, graphics and media used from external sources if not self created will be cited in the references section. All reasonable efforts have been made to ensure the accuracy of all the content in the blog. This website may contain links to third party websites which are not under the control of this blog and they do not indicate any explicit or implicit endorsement, approval, recommendation or preferences of those third party websites or the products and services provided on them. Any use of or access to those third party websites or their products and services is solely at your own risk.